(Economist) Quantum computing is becoming a commercial proposition according to this lengthy Economist article. Venture capital is beginning to flow into companies built around quantum computers, as investors make a bold—possibly foolhardy—bet that even the limited, error-prone, unstable machines that make up the state-of-the-art today may prove commercially useful.

For most of the field’s history, quantum-computing research has been backed by governments or big information-technology firms. Increasingly, though, the venture-capital (vc) industry is showing an interest. PitchBook, a research firm based in Seattle, has tracked $495m of vc money that has been invested in quantum computing so far this year—almost double last year’s total (see chart). Dozens of startups are competing with the incumbent tech giants. And established companies, such as Daimler, a carmaker, and Goldman Sachs, a bank, are beginning to experiment with the nascent industry’s products, hoping that, if they can master them, they will bestow an advantage over their competitors.

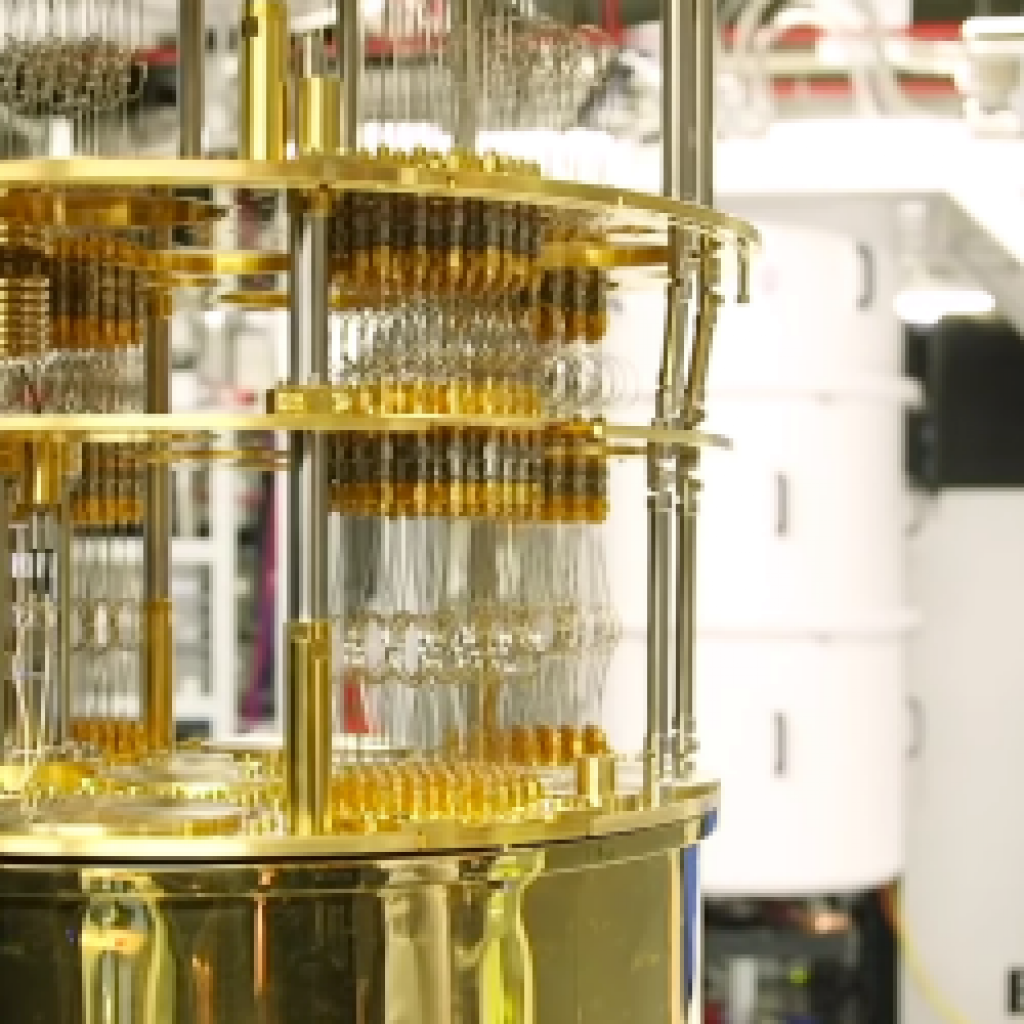

Much of the money is going towards building hardware. Unlike classical computing, which had settled by the 1970s on silicon transistors as the units of computation, there is, as yet, no consensus on the best way to build a quantum computer. Ionq, a firm in Maryland that has raised $84m, uses trapped ytterbium ions, manipulated by lasers, to perform its calculations. Rigetti Computing, a Californian company which announced earlier this month that it would be building a quantum computer for the British government, employs microwaves to control pairs of electrons flowing through superconducting circuits.

One particularly well-financed new firm is PsiQuantum, which does its computing with photons that run along waveguides etched onto ordinary silicon chips.

Other firms are concentrating on making quantum computers easier to work with. q-ctrl is an Australian startup that has raised “tens of millions” from investors including Sequoia Capital and In-Q-Tel (which invests on behalf of America’s intelligence agencies). “We build ‘quantum firmware’,” says Michael Biercuk, one of the company’s founders.

The next step is to get it into the hands of potential customers. IBM’s “Q Network”, established in 2017, is a cloud-computing service that lets clients use the firm’s own quantum computers. ibm now has partnerships with dozens of established firms, including Daimler, Samsung and Goldman Sachs, which are intended thus to explore the technology.

Smaller hardware-makers, lacking ibm’s reach, have joined up with other cloud-computing firms. Microsoft (whose own topological machines are still at an early stage of development) offers access via Azure, its cloud-computing service, to machines from IonQ, Honeywell and a company called Quantum Circuits. Amazon hosts machines from Rigetti, IonQ and D-Wave, a Canadian company that builds specialised, fixed-purpose computers called quantum annealers.

This influx of money hasled some researchers to worry that hype may be overtaking reality, and storing up disappointment for the future. Some of the cash, says Dr Biercuk, comes from vc firms taking calculated risks by investing in what has come to be called “deep tech”—cutting-edge, highly technical projects like quantum computing. But he cautions that there is no shortage of hype-struck “dumb money” sloshing around, too.

Economist: Quantum Computing Becoming a Commercial Proposition