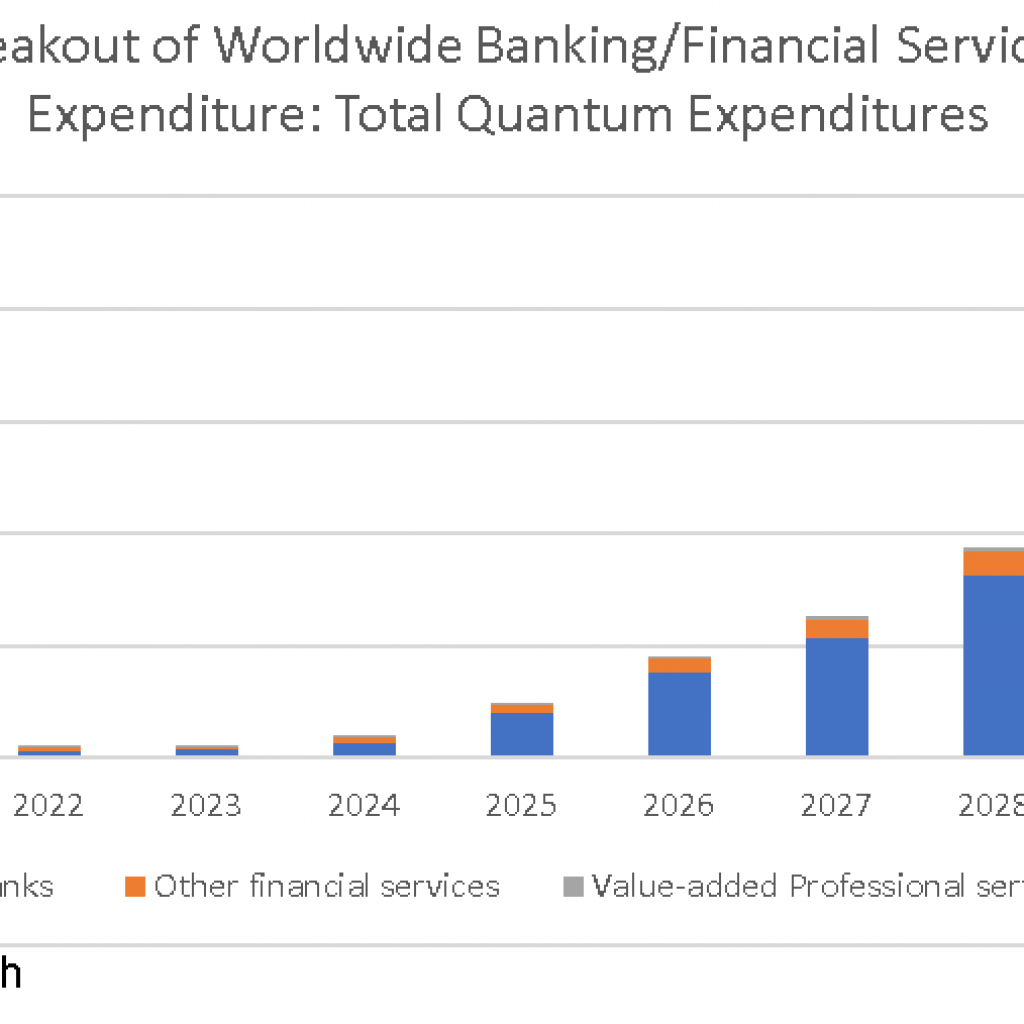

New York, NY: According to a new report from Inside Quantum Technology, worldwide expenditures for Quantum Computing will exceed $630 million in 2027 and then go on to around $2.2 Billion by 2030.

More details on the report, Quantum Computing Applications in the Financial Services Industry:

End-User Cases and Market Forecasts can be found at: https://www.insidequantumtechnology.com/product/quantum-computing-applications-in-the-financial-services-industry-end-user-cases-and-market-forecasts/

For Sample Requests: Click on “Request Excerpt” in this link.

About the Report:

This report describes the opportunities, challenges and deployment options surrounding the application of quantum computing in the banking and financial services vertical. It discusses in detail the role that quantum computing plays in portfolio management and construction, currency arbitrage, fraud detection, trade settlements, analytics-driven CRM, credit scoring, risk modeling, tax-loss harvesting and derivative pricing. In addition, the report looks at quantum computing’s role in accelerating the use of AI and machine learning in the financial services sector.

The report provides a ten-year forecast of what the banking and financial services sector will spend on quantum computing in the next decade, and it discusses the evolution of quantum computing in the financial services sector from the current “proof of concept phase” to widespread usage in a decade or so. The report looks at smaller and less-expensive quantum computers that could, for example, be used in smaller financial institutions and in the role of network computers in transaction networks.

This report concludes with a review of the current plans of what the leading full-stack quantum computer makers are planning for the financial services space. It also provides a focus on sales strategy to sell banks and other financial institutions on using quantum computing.

From the Report:

- The mathematics is out there, hardware is the throttle. There are sufficient proofs of concept to establish that quantum code works and brings significant value. Production usage of quantum computing in financial services is currently limited by hardware, based on our interviews. Financial services want their code to be hardware independent. This requires independent software stacks supporting familiar languages like Python, C++, etc.

- Financial service enterprises have invested significantly to identify specific use cases that will be most beneficial when quantum computing attains commercial grade scale. Managers in banks and related institutions are seeing machine learning as an early value deliverer since it can fit into a hybrid computing model combining quantum with classical computing. Gradually, more applications for quantum computing will show how they can translate into value streams for the financial sector. In other words, as part of the sales process, potential end users must understand that buying into quantum technology will be useful to them.

About IQT Research:

IQT Research is a division of 3DR Holdings, and the first industry analyst firm dedicated to meeting the strategic information and analysis needs of the emerging quantum technology sector. In addition to publishing reports on critical business opportunities in the quantum technology sector, Inside Quantum Technology produces a daily news website on business-related happenings in the quantum technology field. https://www.insidequantumtechnology.com/.

3DR Holdings organizes the Inside Quantum Technology conferences. The next conference “Inside Quantum Technology – The Hague” will be held February 21-23, 2022 and covers all aspects of quantum technology. It will be a hybrid event based in the Netherlands. https://iqtevent.com/thehague/

For more details on the report, contact:

Lawrence Gasman

lawrence@insidequantumtechnology.com

Telephone: 434-825-1311