Quantum Particulars Guest Column: ““FinTech Q.0 – Optimizing Corporate Capital Structure With Quantum Technology“

“Quantum Particulars” is an editorial guest column featuring exclusive insights and interviews with quantum researchers, developers, and experts who examine key challenges and processes in this field. This article, written by Ethan Krimins, CEO of Quantum Research Sciences, discusses quantum technology optimizing the corporate capital structure.

As of this writing, there are a limited number of real-world applications for quantum algorithmic optimizations. That will change as the availability of quantum computers and the number of usable qubits increase to cover more practical use cases. In the meantime, the window for applying today’s technology is where limited but multiple-input, strongly connected, low-variation factors can be discretely manipulated.

Over the past four years, Quantum Research Sciences LLC has successfully applied this scoping to one of the world’s largest and most complex supply chains. As far as we know, we are the first company to deliver operational, live-data, production-level quantum software.

When a supply chain is looked at through a financial lens (i.e., inventory is categorized as equity or debt that is changing over time), our analysis found that corporate capital structure is a good adjacent area for applying quantum optimization.

Today’s real-world corporate environment calls for a dynamic capital structure methodology; rapidly changing macro and micro conditions impact multiple diverse customer and supplier influences at different lifecycle stages, unpredictable competitors influence with classified capabilities, and all while there is the potential for physical or economic fluctuation of resources.

As such, a credible corporate capital structure needs to be able to adapt in real time and ensure precise fiscal recommendations; in short, the corporate capital structure needs to be optimized.

A View of Current Corporate Capital Structure

At most public companies, capital structure is a balancing act of approximately 10 to 20 securities. These always include basic equity issuances and bonds, but there are also preferred stock classes, warrants, debentures, and a finite range of other debt instruments. All of which are usually measured against net income (maximization) and tax (minimization).

Corporate Treasurers’ juggle the above instruments depending upon external elements such as lending rates, borrowing rates, regulatory changes, and credit adjustments, as well as internal factors affecting their financial statements such as cash flow, valuations, liabilities, etc.

For the past century, each corporate treasury team for every public company has attempted to optimize via manually juggling their ledgers, whether it be on paper or spreadsheets. However, today’s ever-increasing range of instruments and elements is getting too complex for classical optimization. Additionally, the world’s ever-open markets enable nearly 24×7 exchange of debt and equity positions.

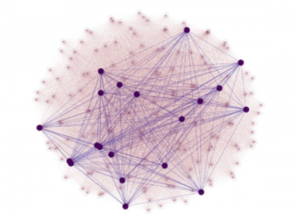

For capital environments just slightly more complex than this, utilizing a quantum process is the only currently available capability to deliver a true optimization of this intricacy. As an example, our quantum algorithms identified the below optimal capital structure in seconds using a quantum computer. A similar analysis would take any investment bank or corporate finance team weeks or months, and even then, we submit those I-bankers and finance teams are relying on heuristics, which dilutes, if not defeats the purpose of an optimization.

The above graphic represents an actual quantum optimization of a real-world capital structure, something not possible with classical technology. In this example, it took a quantum machine seconds to identify a best-fit aggregation of 20 equity and debt securities out of 100.

There are two approaches we have undertaken to tackle corporate capital optimization. One is utilizing an annealing quantum computer, which has impressive capabilities and is visually displayed in the figure. We are also developing a use-case for a neutral atom computer.

On a neutral atom system, we utilize an objective function, which represents one of the most realistic and multifaceted capital structure situations at any given point in time. This is because the equation does not simplify scenario probabilities. In other words, each ‘instrument-to-element interaction’ probability is unique, and each ‘element-to-corporation interaction’ probability is unique.

Our approach with a neutral-atom machine leverages a Quantum Approximate Optimization Algorithm (QAOA) to address the high-dimensional, time-sensitive nature of the capital structure situation. Unlike classical computers, which encode data in binary bits (0s and 1s), Quantum Computers use quantum bits (qubits) which can exist in multiple states simultaneously due to the quantum mechanical phenomena of superposition.

This enables Quantum Computers to quickly deliver automated solutions temporally (e.g., re-assignment of securities while economics evolve). The same equation can be immediately recalculated while capital markets are active. Exploiting quantum speed is an inherent feature valuable to Corporate Treasurers and CFOs.

For larger corporations, a corporate capital quantum optimized solution will pay for itself after a few uses, and possibly after one use. For corporate treasurers or CFOs who are still using spreadsheets to manage 10 or more financial instruments, optimizing their corporate capital structure via our quantum tool is the future.

Ethan Krimins leads Quantum Research Sciences, one of the world’s first companies to operationalize quantum software.