Will We Next See a Quantum Technology Revolution or a Quantum Winter

(Built-in) The question that nobody can answer yet is whether the surge in quantum computing investments made between 2017 and 2018 will result in a bubble. Once that bubble bursts, the market could cool off and result in “quantum winters,” analogous to AI winters: droughts of investment activity that have slowed the growth of AI multiple times in the last decades. Rhea Moutafis, a Ph.D. student in physics at Sorbonne Université and an MBA fellow at Collège des Ingénieurs laying the foundations for a future startup does pose the question and provides a indepth look

Between 2017 and 2018, investors put more than $450 million into quantum computing. That’s more than four times the amount that was invested in the two years prior.

Moutafis provides a quick overview over the top players in the field and the amount of funding they’re currently attracting. The five areas are:

**Instrumentation includes technological components and control platforms to help other companies build quantum computers.

**Quantum software covers different programming languages with applications ranging from data analysis to cybersecurity.

**Sensors can be used to improve imaging, from archaeological sites to ID photos.

**Companies in computing build the actual quantum processors and operating platforms for the end user.

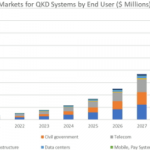

**Quantum communication deals with cryptography, cybersecurity, or even cryptocurrencies.

Since funding is a strong indicator of investors’ confidence in the technology, Moutafis’ list of five areas and the top investors in each could lead to useful insights on the future of quantum startups.

He explains that he is a trained physicist and has no doubt that quantum is the future. However, the companies that will make quantum computing accessible to everyone may not even exist yet. Moutafis wouldn’t advise you to invest your money and time into quantum technology just yet, unless you have a solid background in quantum physics, and expertise that goes beyond the scope of this article.

“Even if you don’t buy in just yet, I’m positive that there will still be great profit margins for startup founders, employees and investors alike further down the road.”

NOTE: The original article is worth a click through to source for its details-especially in the description of the five categories of companies and their investors.